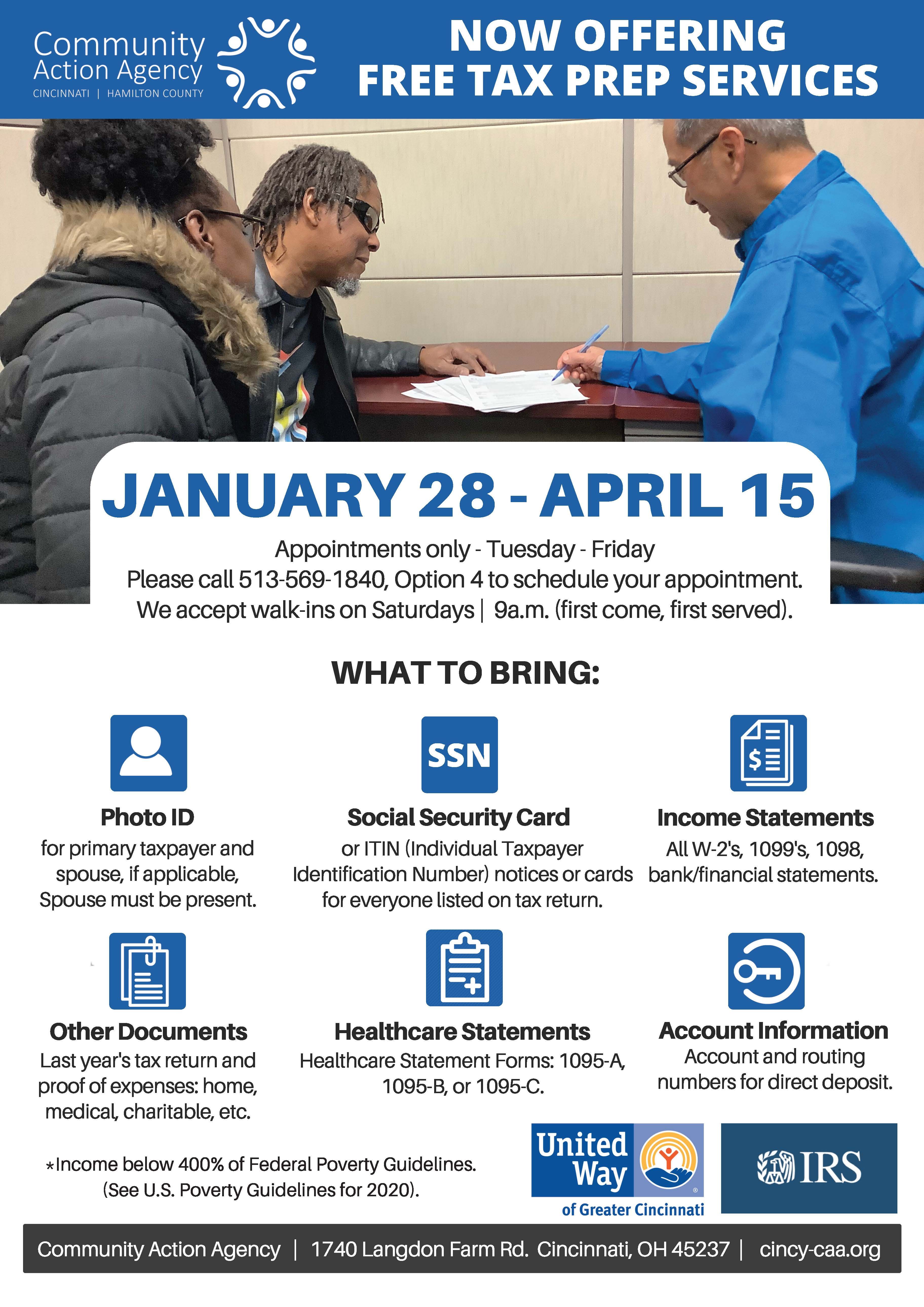

Your Community Action Agency is offering FREE tax prep services for qualifying households from January 28 through April 15, 2020. Income must be below 400% of the Federal Poverty Guidelines. See U.S. Poverty Guidelines for 2020 to determine if you qualify or call us at 513-569-1840, option 4 for assistance or visit us online.

Appointments Only – Tuesday thru Friday:

Please call: 513-569-1840, Option 4

Walk-ins – Saturdays:

9 am, First Come, First Served

The number of walk-ins is based on the number of tax preparers on site.

You Must Bring:

- Photo ID for primary taxpayer and spouse, if applicable, Spouse must be present.

- Social Security cards or ITIN (Individual Taxpayer Identification Number) notices or cards for everyone listed on the tax return

- All W-2’s, 1099’s, and other income documents

- Any 1098 forms received from colleges and receipts

- Health Care Statement Forms: 1095-A, 1095-B, or 1095-C

- Last year’s tax return

- Account # and routing # for direct deposit of tax refunds

- Information for expenses: home, medical, charitable, etc.