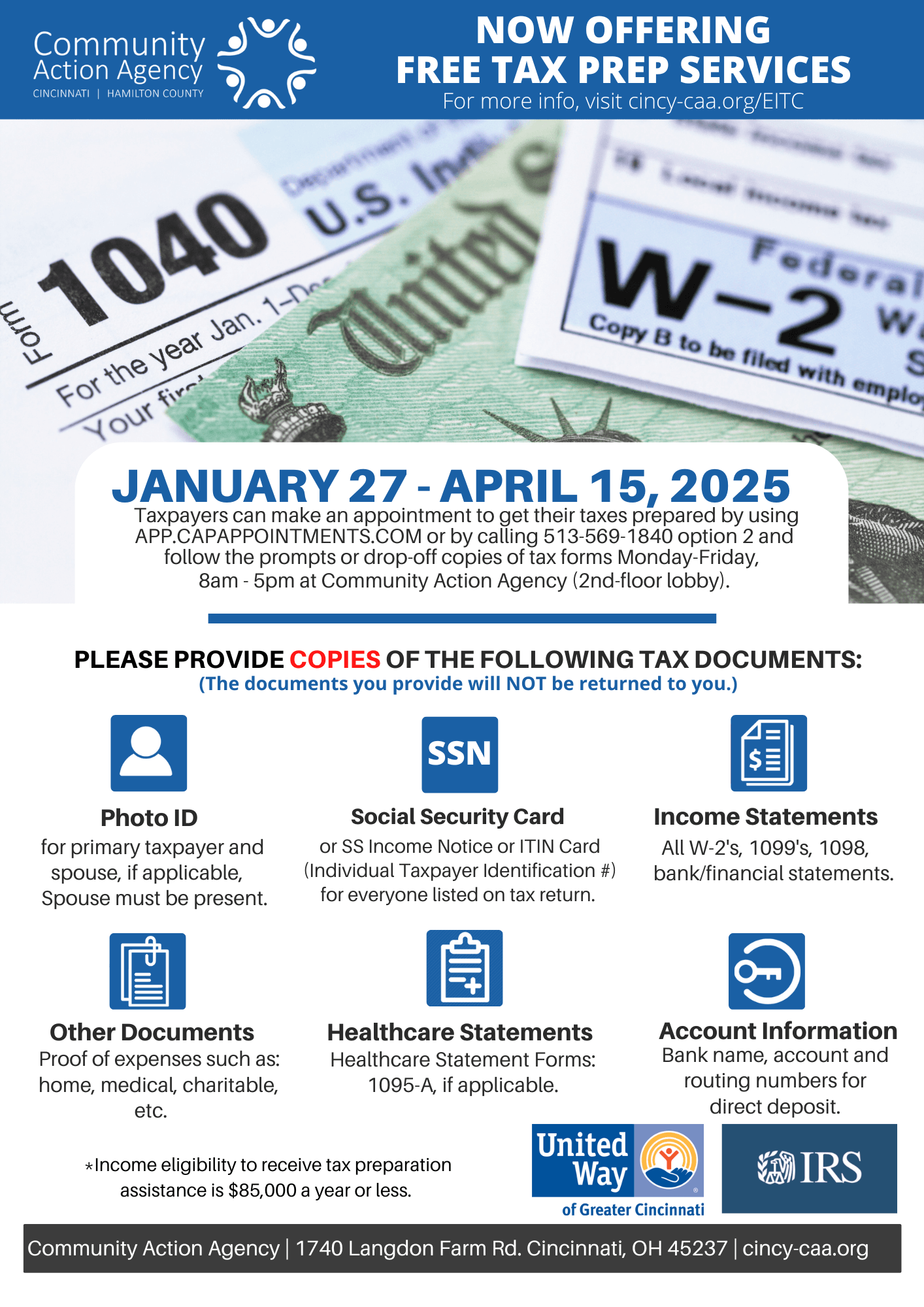

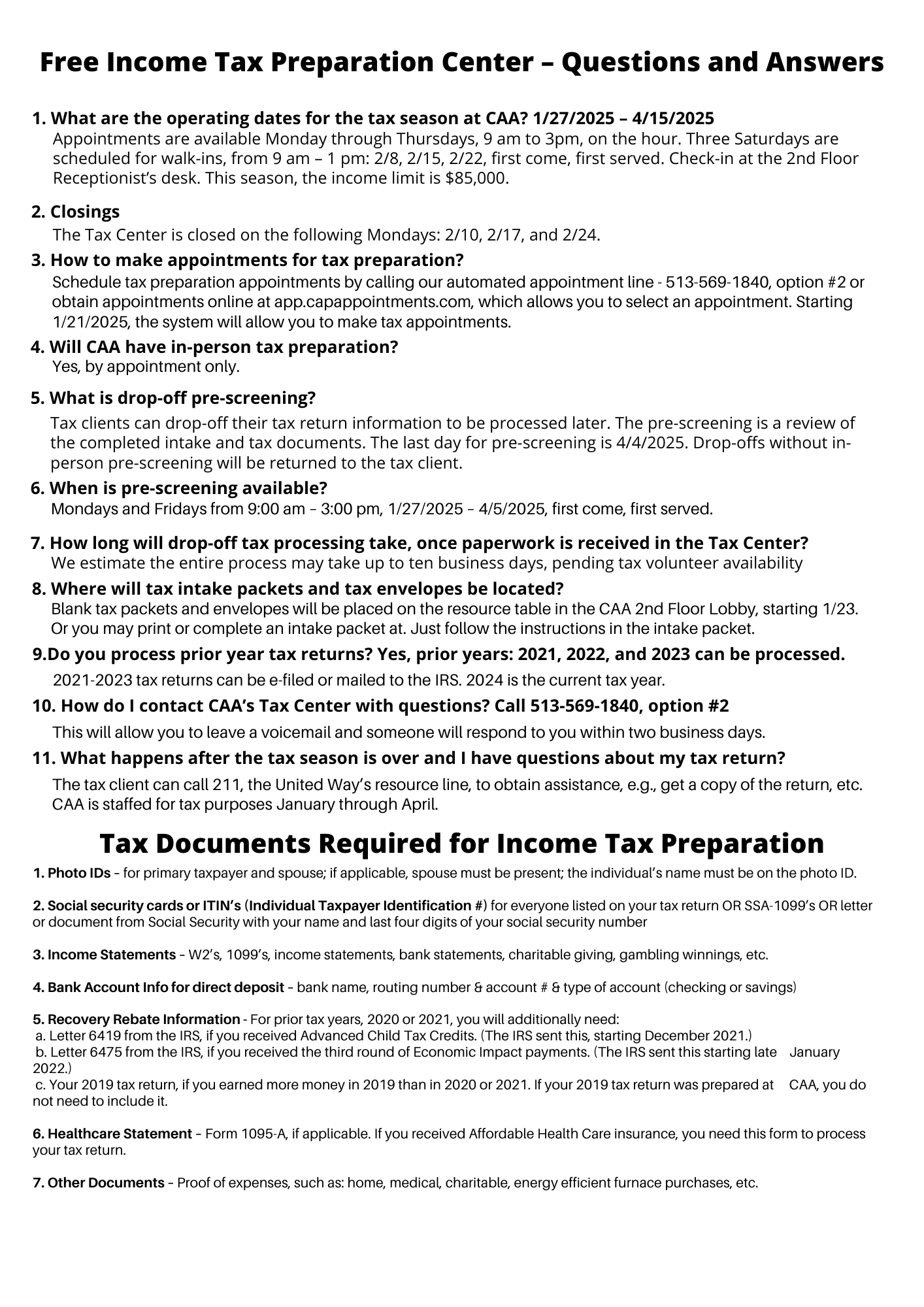

FREE INCOME TAX RETURN PREPARATION SERVICES

From January through April CAA provides free tax return preparation services to individuals with income up to $85,000, with no rental property. Refunds from tax processing are deposited into your checking account or mailed to the address specified in your tax return.

We also provide processing of prior year returns for tax years: 2021, 2022, and 2023.

The three methods of tax preparation this season are:

1. By appointment

2. By walk-in Saturdays

3. By drop-off of tax documentation and intake packet

Note: The Tax Center will be closed on the following Mondays: 2/10, 2/17, and 2/24.

This above intake packet is used for tax return processing. Please carefully follow the instructions.

1. BY APPOINTMENT

- Call 513-569-1840 option 2 and follow the prompts to obtain an appointment to have your tax return(s) prepared. Only one tax return per appointment is allowed. You may also use the following link to obtain an appointment:

- ONLINE APPOINTMENT SCHEDULING

- Please come 15 minutes before your appointment time to complete the intake form.

- To check-in for your appointment, please enter CAA via the 2nd Floor Lobby, take a number, and please be seated. The Receptionist will call your number to verify the appointment and notify the Tax Center.

- A tax volunteer will call your name and take you to your appointment.

- Your tax documents and completed/printed return will be returned to you for your review and signature.

2. DROP-OFF HOURS

IN PERSON PRE-SCREENING OF TAX DOCUMENTS IS REQUIRED.

Mondays (12 PM – 3:30 PM) and Fridays (9 AM – 3:30 PM), first come, first served

Pre-screening helps to ensure that copies of tax documents and the intake packet are complete. You may leave copies of your tax documents with the tax volunteer after successful pre-screening.

DROP-OFF RETURN FOLLOW-UP

- You will be notified by email, text, or phone call when the Tax Office has received your documents.

- After your return is prepared, a password-encrypted copy of your tax return will be emailed or mailed to you for your review. A Reviewer will coordinate this with you.

- A Reviewer will contact you to obtain your approval to e-file your tax return(s). The Reviewer will ask you to send a text or email message indicating your approval of the return or you may sign your return through Get Your Refund.

In special cases, e.g., illness, infirmity, etc., the Reviewer may elect to receive a verbal approval for e-filing your tax return.

- We prefer that you make arrangements with the Reviewer to pick-up and sign your return(s) at our Tax Office. Or upon your approval, your return(s) will be e-filed and a copy will be emailed or mailed to you.

3. WALK-IN SATURDAYS

On 2/8, 2/15, and 2/22, we will have walk-in tax processing from 9 AM to 1 PM; first come, first served.

ADDITIONAL INFORMATION

All tax documents are shredded at the end of the tax season.

Documents that you provide will not be returned to you.

We anticipate the processing time to take up to 10 business days after drop-off or upload of tax documents. The processing time may vary pending the completeness of tax documents and the availability of tax volunteers and taxpayers.